Two Methods of Accounting for Uncollectible Accounts Are the:

Aging accounts receivable method. The two methods used for uncollectible accounts are.

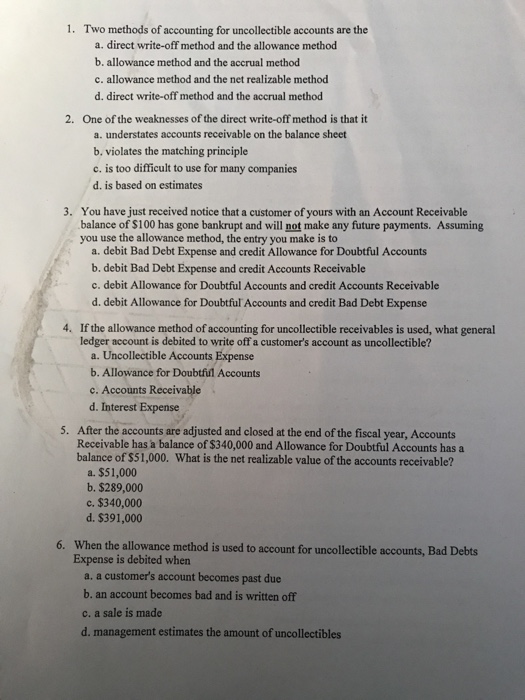

Solved 1 Two Methods Of Accounting For Uncollectible Chegg Com

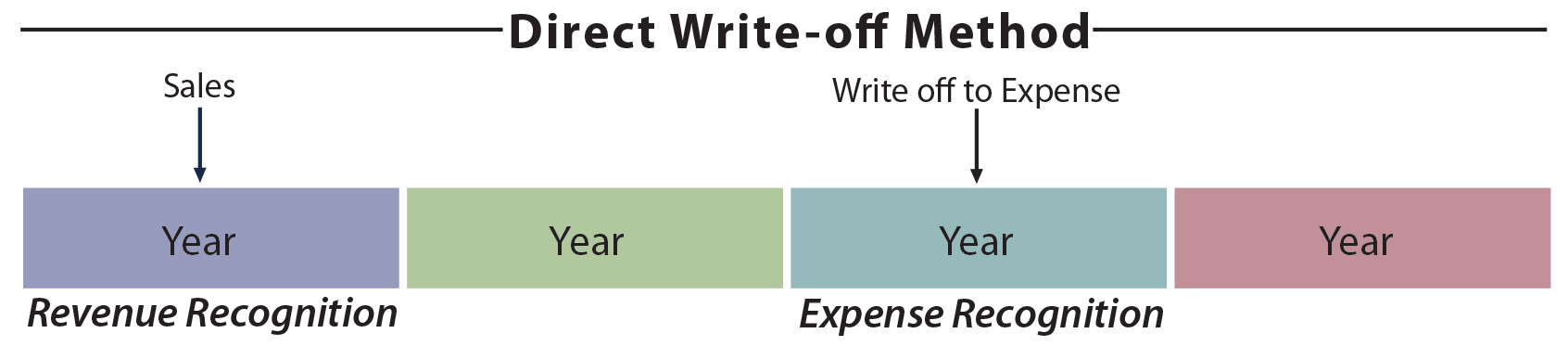

A simple method to account for uncollectible accounts is the direct write-off approach.

. Two methods of accounting for uncollectible accounts are the a. The direct write-off method records Bad Debt Expense in. 1 the Direct Write-off Method and 2 the Allowance Method.

Direct write-off method and the accrual method. There are two methods of accounting for uncollectible accounts. Let us start with the allowance method.

What is another name for Allowance for Doubtful Accounts. Of the two methods of accounting for uncollectible receivables the allowance method provides in advance for uncollectible accounts. Identify the accounts debited and credited to account for uncollectibles under a the allowance method and b the direct write-off method.

The appropriate entry for the direct write-off approach is as follows. Under this technique a specific account receivable is removed from the accounting records at the time it is finally determined to be uncollectible. Two different methods commonly used to estimate uncollectible accounts receivable are the percentage of sales method and the accounts receivable aging method.

Direct write-off method and the accrual method 2. Limitations of the Direct Write- Off Method. The direct write-off method and the allowance method.

Bad debts expense is usually record. We shall discuss both the methods one by one. The direct write-off method recognizes impairment loss or bad debts expense by crediting directly the receivables account.

The method of accounting for uncollectible accounts that results in a better matching of expenses with revenues is the a. Allowance method and the net realizable method. Allowance method and the net realizable method d.

The key concept is to record uncollectible accounts expense in the same period as the sales revenue. Generally accepted accounting principles do NOT normally allow the use of the direct write-off method of accounting for uncollectible accounts. Allowance for Doubtful Accounts has a credit balance of 500 at the end of the year before adjustment and uncollectible accounts expense is estimated at 3 of net sales.

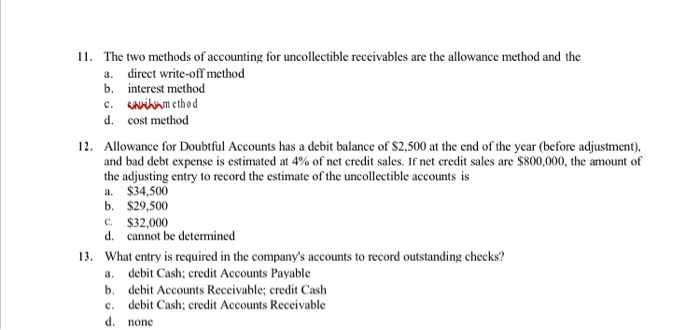

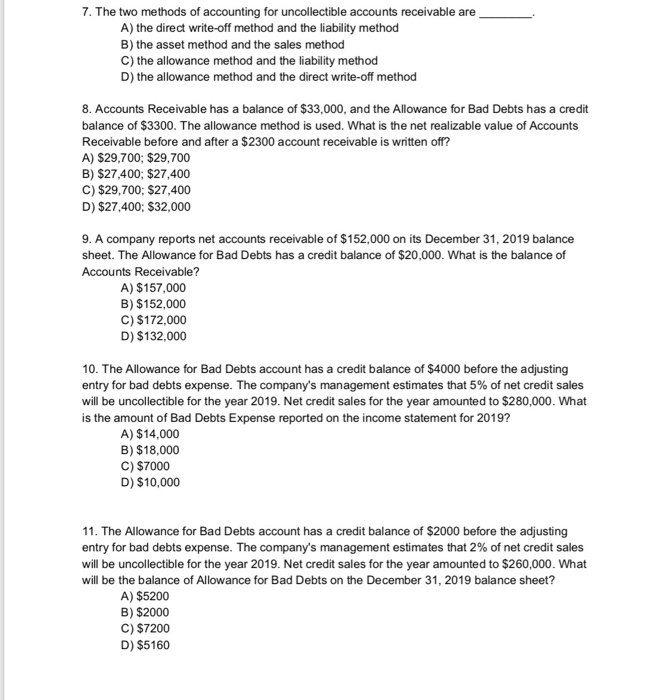

The two methods of accounting for uncollectible accounts receivable are ________. 1 the Direct Write-off Method and 2 the Allowance Method. C allowance method and the accrual method.

O The offset to the expense is a contra account called Allowance for uncollectible. Interestingly the first is a fact and the second is an opinion. An operating expense.

Uptown Company has determined that an account receivable of 125 is uncollectible. Direct write-off method and the allowance method. Two methods are used in accounting for uncollectible accounts.

Both methods result in the same accounts being debited and credited but because the methods are different they usually result in different dollar amounts for the journal entry. Two methods are used in accounting for uncollectible accounts. Two Methods of accounting for uncollectible receivables.

When a specific account is determined to be uncollectible the loss is charged to Bad Debt Expense. The Direct Write-Off Method of Accounting. 1 the Direct Write-off Method and 2 the Allowance Method.

Answer Explanation for Question. Two methods of accounting for uncollectible accounts are the Entry field with correct answer a direct write-off method and the allowance method. The Allowance Method 2.

Two methods are commonly used for recognizing uncollectible accounts expense in the books of seller. Which of the two methods of accounting for uncollectible accountsthe allowance method or the direct write-off methodis preferable. The Direct Write-off Method The Allowance Method Allowance method is based on the matching principle.

Direct write-off method When a specific account is determined to be uncollectible the loss is charged to Bad Debt Expense. Percentage of receivables method. Two methods of accounting for uncollectible accounts are the.

Click to see full answer. What are the two methods of accounting for uncollectible accounts. Two methods of accounting for uncollectible accounts are the.

Allowance method and the accrual method. The two are then combined to arrive at the net realizable value figure that is shown within the financial statements. Direct write-off method and the accrual method.

Two methods are used in accounting for uncollectible accounts. Two methods of accounting for uncollectible accounts are the direct write-off method and the allowance method. When a specific account is determined to be uncollectible the loss is charged to Bad Debt Expense.

Allowance method and the net realizable method. Direct write-off method and the allowance method b. These are allowance method and direct write off method.

Direct writeoff method where actual losses from uncollectibles are charged directly to bad debts expense. The allowance method and the direct write-off method. Allowance method and the accrual method c.

Two methods of accounting for uncollectible accounts are the a. Direct write-off method and the allowance method. The company uses the direct write-off method.

One is the sum of all accounts outstanding and the other is an estimation of the amount within that total which will never be collected. Allowance method and the accrual method. Bad debts expense will show only actual losses from uncollectibles.

Please log in or register to answer this question. B allowance method and the net realizable method.

What Are The Steps In Recording Closing Entries P S Of Marketing Accounting Books Financial Statement

Solved Which Of The Following Are The Two Methods Of Chegg Com

Mortgage Statement Template Check More At Https Nationalgriefawarenessday Com 45148 Mortgage Statement Template

Accounting Accounts Receivable

Some Core Concepts Of Accounting Accounting Meaning Of Capital Meaning Of Journal

Bad Debts Meaning Example Accounting Recovery Provision Etc 849491548446060987 Accounting And Finance Bad Debt Financial Accounting

High Low Method Accounting Meaning Formula Example And More In 2021 Accounting Accounting Principles Accounting Education

8 Steps Of The Accounting Cycle Accounting Basics Accounting Cycle Accounting

Solved 11 The Two Methods Of Accounting For Uncollectible Chegg Com

Compare Two Methods Of Accounting For Uncollectible Receivables Digital Depot Company Which Operates A Chain Of Homeworklib

Solved 7 The Two Methods Of Accounting For Uncollectible Chegg Com

Allowance For Doubtful Accounts Meaning Accounting Methods And More Learn Accounting Accounting Accounting Basics

Bad Debts Accounting And Finance Money Management Financial Accounting

Compare Two Methods Of Accounting For Uncollectible Receivables Digital Depot Company Which Operates A Chain Of Homeworklib

Solved 6 3 Compare Two Methods Of Accounting For Chegg Com

Direct Write Off Method For Uncollectible Accounts Principles Of Accounting Youtube

Allowance Method For Uncollectible Accounts Principles Of Accounting Youtube

Accounting For Uncollectible Receivables Principlesofaccounting Com

Types Of Invoice Bookkeeping Business Accounting Classes Accounting Student

Comments

Post a Comment